👨🏼⚖️ Episode VI: Return of the Tariffs

Hello investors!

As you may (or may not) have noticed, there was no newsletter last week. I'd like to apologize, as my wife and I were a bit tied up welcoming our child into the world. Her name is Bella, and both she and Mama are happy and healthy. 💕

I ask that you please extend some grace for a shorter-than-usual edition of the newsletter this week as I get back on my feet as a new dad. We will be back to regularly sheduled programming next week. And I have a feeling there will be plenty to cover, so you can bet I'll be here to guide you through it all.

Oh and if you are so inclined, I would love to hear from you: what's your best piece of parenting advice for a new dad? I'm all ears!

-Brian

In Today's Issue:

🥇 The TACO Trade is sooooo last month.

🥈 Bitcoin is hitting new all-time highs.

Markets

Who's The Chicken Now?

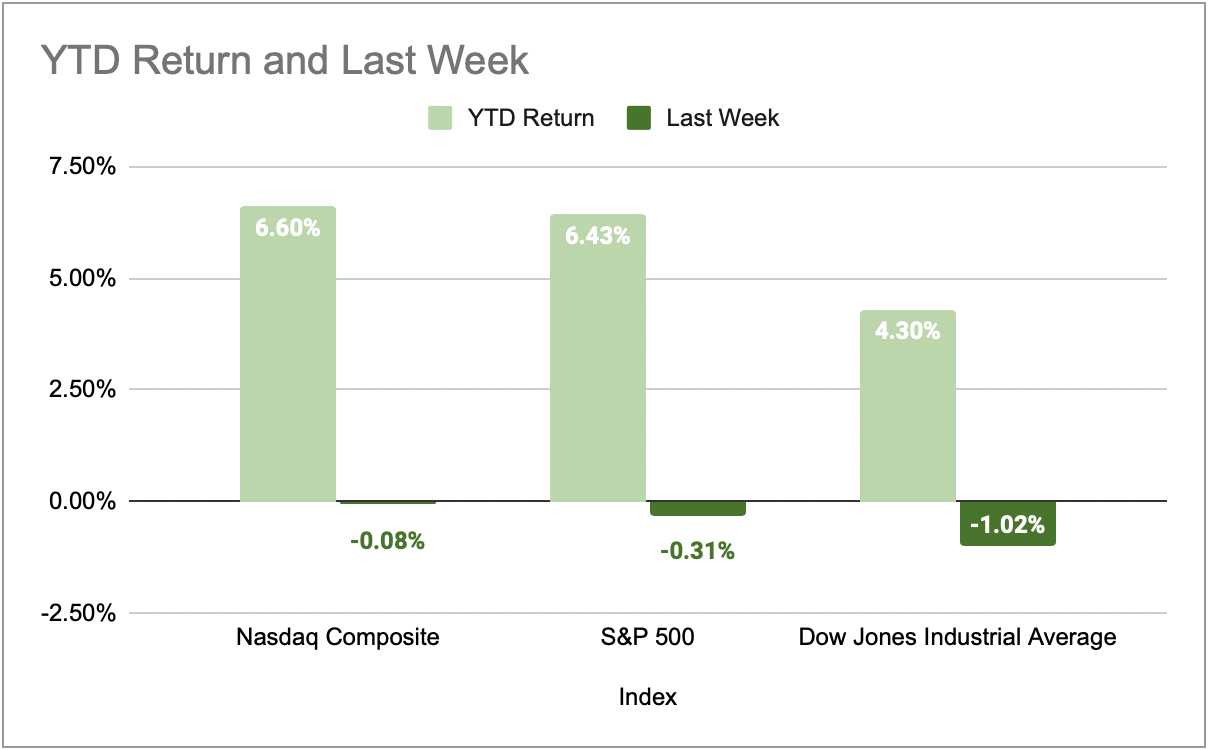

Last week, the S&P 500 closed 0.31% lower while the tech-heavy Nasdaq was roughly flat and the Dow Jones Industrial Average fell 1.02%. While stocks started off the week strong, investors slowly backed out of the room as various U.S. trading partners began receiving letters notifying them of their new tariff rate effective August 1st.

This is a change of pace from prior months in which markets largely shrugged off talks of tariffs in what became known as the "TACO Trade." Investors have largely played a game of chicken with the President's trade policy, betting that Trump will "Always Chicken Out." However, this time around, investors seem to be taking the real estate mogul a little more seriously.

While there is some confusion about whether or not the latest tariff rates are set in stone or up for negotiation, what is clear is that the rates themselves have not changed much from the so-called "Liberation Day" in April, and the deadlines for these tariffs are getting shorter and shorter. I guess we'll see who the chicken is soon enough.

Cryptocurrency

The Second Coming of Bitcoin

As of this writing, Bitcoin is trading just under $119,000 and has been setting new all-time highs throughout the week. According to CNBC, this momentum is driven by institutional investors buying up Bitcoin-related ETFs. On Thursday, bitcoin ETFs received over $1B of inflows, marking the largest day of investment so far in 2025.

Ethereum on the other hand, which was meant to be a more useful version of Bitcoin, has not received the same love from investors. The alternative cryptocurrency is down near 11% for the year, and has not made much headway over the past ~4 years. Bitcoin has more than doubled over that same period.

And public companies are taking note. As of July 13, 2025, 33 public companies hold 1,000 or more Bitcoins. While Bitcoin juggernaut Microstrategy sits comfortably in the #1 spot with close to 600,000 Bitcoins, other notable companies include Tesla at 11,509 BTC, Block (formerly Square) with 8,584 BTC, and Gamestop with 4,710 BTC.

There is no doubt that Bitcoin is becoming a core part of our financial system. The only question is whether that is a good thing.

Responses