🪙 $1 Billion in Pennies

Hello investors!

This week, the United States Treasury announced that it will no longer produce pennies. As an homage to the Abe Lincoln coinage, here is some interesting trivia that will also help explain the situation:

- It costs about 4 cents to make 1 penny

- The penny was originally introduced in 1793

- There is over $1B in pennies currently in circulation

- Stopping production is estimated to save $56M per year

I would love to know: when's the last time you used a penny to pay for something?

-Brian

In Today's Issue:

🥇 Bonds are in the Driver's Seat

🥈 The Big Beautiful Bill

🥉 Trump Accounts, Explained

Markets

The Name's Bond...

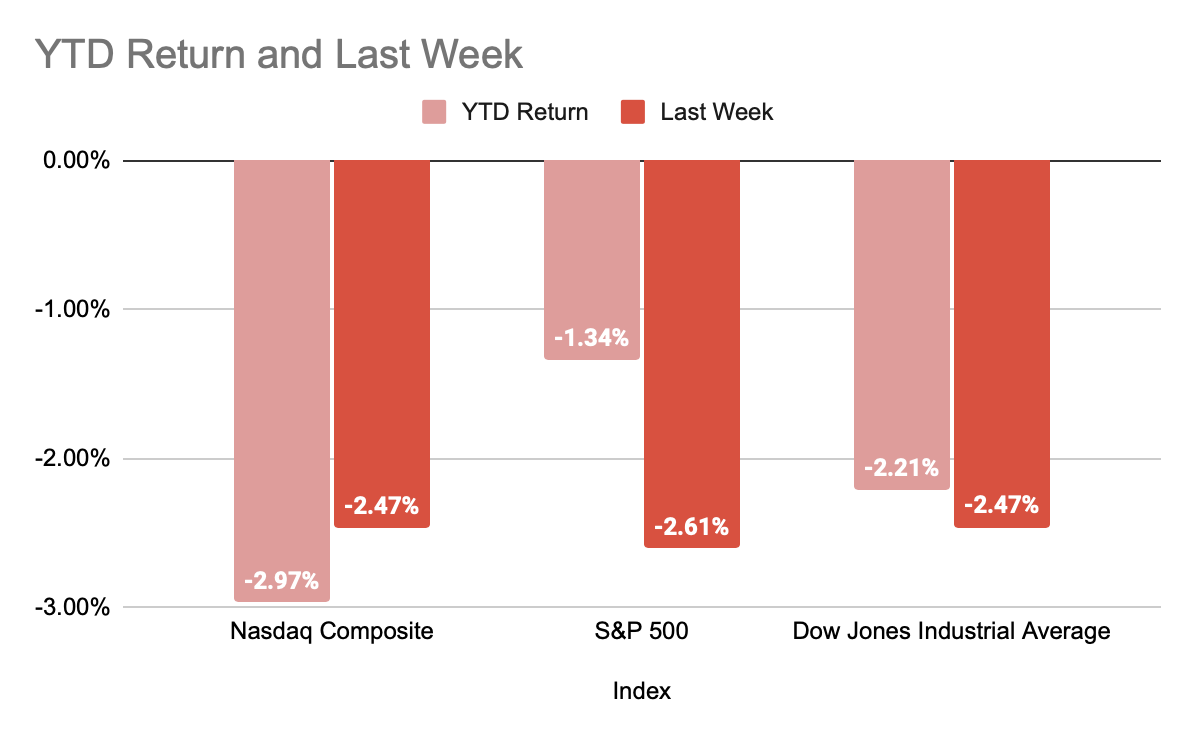

Last week, the S&P 500 closed down 2.61% while the tech-heavy Nasdaq closed down 2.47%. Not to be left out, the Dow Jones Industrial Average also closed down 2.47% on the dot. In almost 15 years of investing and following markets, I can't remember when two major indexes moved the same exact % in a week.

This softness in stock performance has been largely been tied to an increase in government bond yields, which is associated with an economy that is in pretty rough shape. Bond investors are demanding higher yields from U.S. Government debt because the risk that we will default on our debt has increased.

In some cases, this can spiral out of control. When yields increase, then the U.S. government has to spend more on interest payments. When interest payments increase, it increases the likelihood that we default on our debt, which increases bond yields, and I think you see where this is going. Luckily, there are steps you can take to invest profitably during a recession, which you can find in my YouTube playlist here.

Taxes

The Big Beautiful Bill

President Trump's signature tax cut bill passed the House last week by one vote: 215-214. Here's what's in it:

- Trump 2017 Tax Cuts extended: You won't see a difference in your tax bill as a result of this, But without this bill, your taxes would have gone back up to pre-2017 levels.

- No Tax on Tips & Overtime: These were tentpole campaign promises, but reading into the bill shows that there are LOTS of loopholes to claim these benefits, and they expire in 2028, just three years from now.

- Car Loan Interest Deduction: If you pay interest on a car loan, you can deduct it from your income taxes, but the car has to be made in the U.S...more red tape.

- SALT: State and Local Tax deductions have been increased from $10,000 to $40,000. This was a huge change that seemed to not get much coverage, but this would benefit taxpayers that have large spending every year. In california for example, sales tax is ~8%. To benefit from the full deduction, you would need to spend ~$500K during the year.

There are a few other changes, but these four are the ones that will have the biggest impact for most taxpayers. It's also important to remember that the bill still needs to go through Congress and will likely change some more in order for it to pass through to become law. Don't worry though, because I will have you covered on all the info you need to know here and on my YouTube channel.

Babies

Trump Accounts, Explained

Included in the Big Beautiful Bill is a new benefit called "Trump Accounts." Originally set to be called "MAGA Accounts," these are investment accounts assigned to children born between Jan 1, 2025, and Jan 1, 2029. For each child, the government will automatically open an account, put $1,000 in it, and invest that money in the stock market. From then on, families can contribute up to $5,000 to the account every year.

While these accounts are being advertised as "tax-advantaged," they don't seem to function all that differently from typical investing accounts. It is unclear if contributions can be deducted against the parents' income taxes, and withdrawals are subject to long-term capital gains tax. 529 accounts on the other hand have many tax benefits associated with them.

Either way, $1,000 is $1,000. Just don't touch that money early unless you're ready to pay extra taxes and penalties.

Responses